Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Kaise Bachein Cheque Bounce Ke Legal Problems Se?

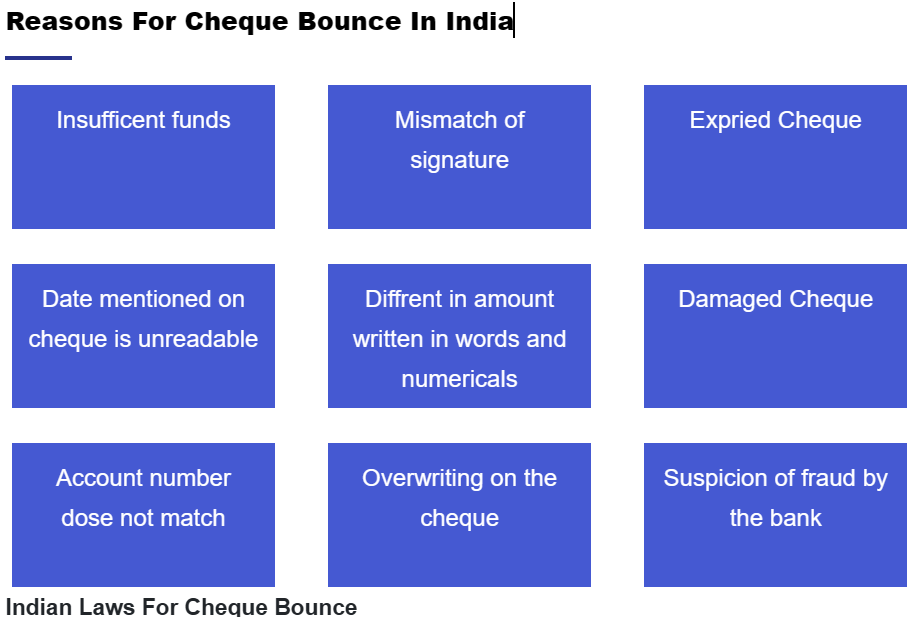

-Hamesha account balance check karein cheque dene se pehle.

– Correct signature use karein.

-Overwriting aur mistake na karein.

– Post-dated cheque issue karte waqt dhyan dein.

– Cheque expiry ka dhyan dein (3 months validity hoti hai).

Legal Action: Cheque Bounce Hone Par Kya Karein?

- Agar kisi ka cheque bounce ho jaye, toh receiver ke paas legal action lene ke do major tareeke hote hain:

1. Negotiable Instruments Act, 1881 – Section 138

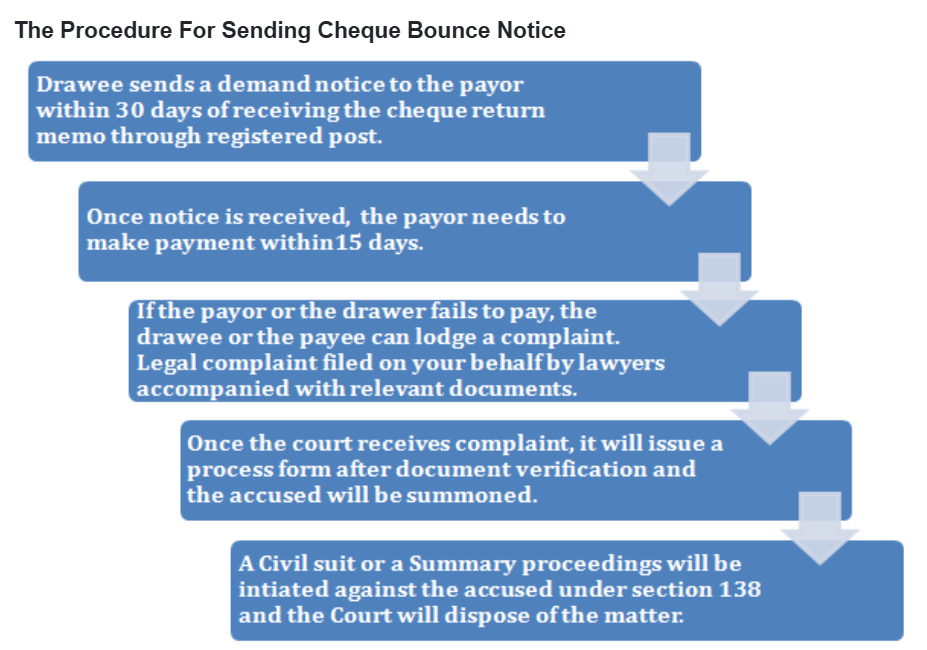

Yeh ek criminal case hota hai jo cheque issuer ke against file kiya ja sakta hai. Iske liye yeh steps follow karne hote hain:

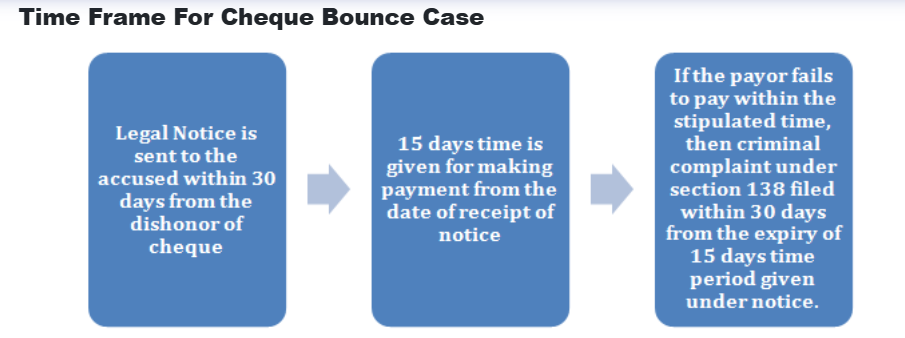

2. Legal Notice bhejna: Cheque bounce hone ke 30 din ke andar receiver ko cheque issuer ko ek legal notice bhejni padti hai, jisme yeh likhna hota hai ki cheque clear nahi hua aur paise wapas do.

3. 15 din ka wait: Notice bhejne ke 15 din tak agar paise wapas nahi milte, toh case court mein file ho sakta hai.

4. Case file karna: 15 din ke andar bhi paisa nahi milta toh magistrate court mein Section 138 ke tahat case file kiya ja sakta hai.

Kaise Bachein Cheque Bounce Ke Legal Problems Se

-Hamesha account balance check karein cheque dene se pehle.

– Correct signature use karein.

– Overwriting aur mistake na karein.

– Post-dated cheque issue karte waqt dhyan dein.

– Cheque expiry ka dhyan dein (3 months validity hoti hai).